The Rise of Ant Group: A Payment Tech Giant vs. Global Fintech Leaders

A Fintech Product Playbook based on Alipay’s Journey with deep dive into technology, business model, product development under regulations, and ecosystem expansion.

Talking about payment tech, I can’t skip mentioning Alipay. It started right in my hometown, Hangzhou, and over the past ten years, as I traveled between the U.S., China, and Japan, I witnessed firsthand how digital payments reshaped daily life. In San Francisco, Square-powered POS systems made card payments seamless. In Hangzhou, I could leave my wallet at home and still buy food, take the subway, or call a taxi—all through Alipay. In Tokyo, cash was still king, but I like to use my “metro cards” Suica and Pasmo to pay in the convenience stores.

It made me wonder: How did Alipay grow into a payment empire? How does its trajectory compare to other fintech giants like PayPal, Stripe, and Square? And what lessons can we learn for the future of payment tech?

From E-Commerce to Digital Payment: The Birth of Alipay

The story of Alipay starts in 2003 when Alibaba was thriving in B2B e-commerce, but eBay had just entered China, pushing Alibaba to launch Taobao, a C2C marketplace. However, there was one big problem: trust. No one wanted to send money to an online stranger without knowing if they’d actually receive their product. Buyers feared scams; sellers worried about bounced payments.

To solve this, Taobao introduced an escrow system. Instead of sending money directly to sellers, payments were held by Taobao and only released once buyers confirmed receipt of their order. This simple but revolutionary model became Alipay. By 2004, 70% of Taobao transactions used it.

Alipay’s Growth: Tech Innovations & Market Expansion

Alipay had multiple expansion strategies and technologies breakthroughs that backed the expansion. They worked well to make them no longer depend on Taobao.

Building an Independent Infrastructure (2005–2009)

Being Taobao’s payment system wasn’t enough—Alipay wanted to break out and become a standalone financial platform. But how? They developed Virtual Accounts, where Alipay created unique IDs for users, linking them to transactions without relying on traditional bank accounts. Besides, instead of forcing companies to use Alipay’s system, Alipay built easy-to-integrate APIs, allowing third-party platforms to embed its payment solution seamlessly.

With these innovations, Alipay quickly expanded beyond Taobao, partnering with World of Warcraft operator The9 for in-game purchases and then moving into utilities, travel agencies, logistics, and airline ticketing. By 2009, Alipay processed ¥1 trillion per year, with half of the transactions happening outside Taobao.

Cross-Border Ambitions Begin (2007–2010)

Alipay’s first step abroad is Hong Kong. It partnered with retailer Sa Sa to test cross-border transactions, a baby step toward global payments.

This mirrors how PayPal expanded into international markets with cross-border transfers and how Stripe built global developer-friendly payments by setting up local partnerships in Europe and Asia.

Quick Payment Revolution (2010–2011)

I remember the painful process of using Alipay in my mom’s Taobao account. Clicking “Pay” would redirect me to my mom’s bank website, where I have to enter my mom’s online banking password, get a security code from her mobile phone, and sometimes even use her security USB. To fix this, Alipay launched Quick Payments, which enabled Alipay to directly debit funds from users’ bank accounts, bypassing the cumbersome online banking process.

This development increased transaction success rates from 60% to 90%, and adoption skyrocketed. To make this happen, Jack Ma actually lobbied major bank CEOs, visiting them over 10 times in 2010 to push for integration. Alipay even parked ¥2 billion as collateral to reassure banks of its commitment.

This was similar to how Stripe won over developers by eliminating the hassle of dealing with banks through seamless APIs when they started in 2010.

From Online to Off-line (2011 to 2015)

By 2011, Alipay was already a major online payment player, but what about offline retail? In the U.S., credit cards and POS systems dominated, and Square was gaining traction with its mobile card readers. But China was different—POS machines were rare. Card infrastructure was weak. Alipay saw an opening and bet on Mobile.

Instead of pushing costly NFC-based payments (like Visa and Mastercard), Alipay launched QR Code payments—a low-cost, scalable alternative. Street vendors and small businesses only needed a smartphone or even just a printed QR code to accept payments. This made adoption frictionless because merchants only need to pay $0.01 for QR transactions cost (much lower than 2-3% credit card fees) and they didn’t need expensive POS machines.

The strategy worked. The low cost on the merchant side larger enhance the network effect: More merchants → more users → more merchants. Since then, every shops in my hometown, even the breakfast stalls, night markets, had a new accessory : printed QR codes. By 2015, 80% of China’s mobile payments flowed through Alipay and WeChat Pay.

We all know that every steps in the payment process funnel out some customers, and now fintech player have evolved different frictionless payment methods for example biometric recognition payments and cashier-less stores.

Face payments, pioneered by Alibaba's Hema and Alipay’s Smile-to-Pay, allow users to complete transactions with a quick facial scan. The technology relies on 3D depth sensing, AI-driven facial recognition, and liveness detection to prevent fraud. Face payments helps improve efficiency in high-traffic retail environments, reducing checkout time and increasing efficiency.

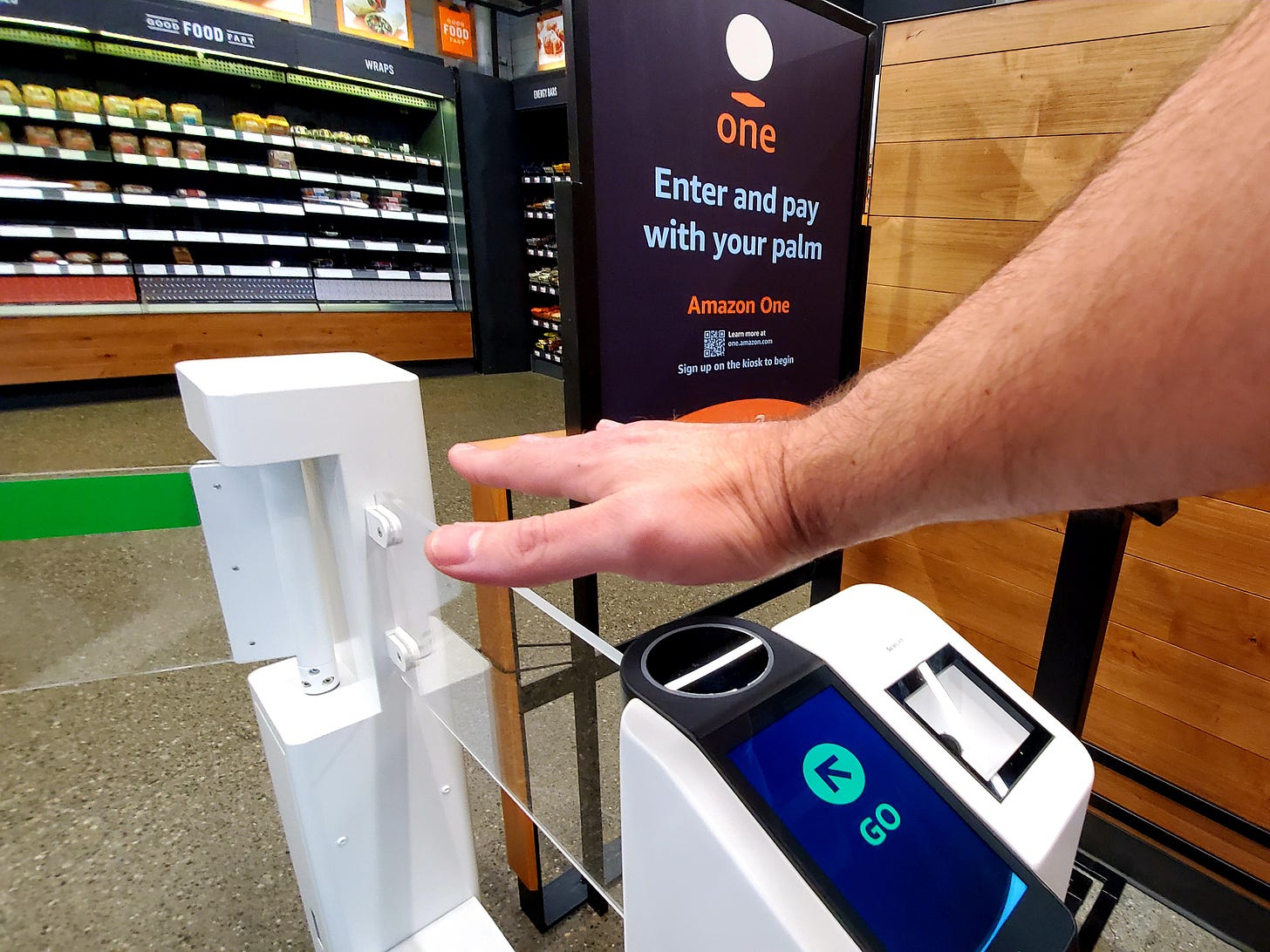

Amazon One’s palm authentication uses near-infrared (NIR) scanning to capture unique vein patterns inside the palm, offering higher security and contactless convenience. Unlike face payments, palm recognition is harder to spoof and feels less invasive, making it a compelling alternative for biometric transactions.

Amazon One palm scanner for payments Cashier-less stores like Amazon Go and Alibaba’s Tao Café integrate computer vision, AI, IoT (shelf sensors, and RFID tracking) to let customers grab products and walk out without stopping at a register—reinventing the retail experience.

These innovations are common in e-commerce players, aim to make payments frictionless (shop more), faster (reduce line), enable connecting offline transaction to users (more data) and more secure while adapting to evolving consumer habits.

Scaling through Cloud (2009 to 2015)

As China’s Double 11 Shopping Festival grew, Alipay’s transaction volume exploded, which posed new challenge for Alipay. In response, Alipay developed OceanBase, a distributed relational database capable of handling massive transaction loads. This innovation ensured system stability and efficiency during peak periods, such as the festival, where transaction volumes could reach unprecedented levels.

Meanwhile, PayPal, Stripe, and Square were scaling their infrastructures differently—Stripe leveraged AWS, while Square focused on edge computing for offline payments.

Building the Ecosystem

Before the establishment of Ant Group, Alipay has developed the ecosystem including Digital Payments, Digital Finance and Digital Life, which included 1000+ services and 2M+ “mini programs” (small apps within a big App).

💡 Global Comparison

Looking globally, both Square (Block) and Alipay (Ant Group) have transformed from simple payment processors into comprehensive financial ecosystems, integrating payments, lending, banking, insurance, and business services. Despite their different origins—Square in the U.S., catering primarily to merchants, and Alipay in China, focusing on consumers—their growth strategies share remarkable similarities.

Core Payments – Alipay pioneered QR code mobile payments, making transactions frictionless for both small merchants and consumers, while Square revolutionized mobile POS and card processing, enabling small businesses to accept card payments easily.

Financial Services – Both companies expanded into lending, offering BNPL solutions (Huabei & Afterpay) and microloans (Jiebei & Square Loans). Additionally, both have digital banking arms—Alipay with MYBank and Square with Square Banking—providing business loans, checking, and savings accounts.

Wealth & Investing – Alipay’s Ant Fortune offers users seamless access to funds, ETFs, and financial products, while Square’s Cash App Investing allows commission-free stock and Bitcoin trading, catering to retail investors.

Insurance & Risk Management – Alipay innovated in micro-insurance, embedding low-cost policies in transactions, while Square partners with Next Insurance to provide small business insurance seamlessly through its platform.

Business Tools & Ecosystem – Alipay has built or acquired a vast suite of merchant services, including e-commerce, ride-hailing, food delivery, and local services. Square, on the other hand, integrates third-party providers like Uber Eats, DoorDash, ClassPass, and MailChimp, focusing on an open ecosystem while offering select in-house solutions.

Building of Ant Group

As Ant Group evolved beyond Alipay, it transformed from a fintech company—a firm using technology to improve financial services—into a TechFin company, where technology is the foundation of its financial services. This shift led Ant to build an ecosystem spanning wealth management, credit & lending, credit scoring, and insurance.

Wealth Management Tech: Yu’e Bao

Ant Group democratized wealth management with Yu’e Bao, which started as a way for Alipay users to earn interest on idle funds in their digital wallets. Launched in 2013, Yu’e Bao allowed users to invest as little as ¥1 in a money market fund (MMF) managed by Tianhong Asset Management.

That was also my very first “saving account” and I was so happy to be able to see see my balance grow daily and all from my mobile phone. When I returned to China in the 2020s, I was surprised to see how much the ecosystem had evolved. My friends were now actively investing in ETFs and other financial products in Ant Fortune, abandoning legacy trading softwares.

As Yu’e Bao grew, Ant Group expanded its wealth management services by launching Ant Fortune, a multi-product investment platform that integrated funds from third-party asset managers starting in 2018. This move diversified Ant’s investment offerings, providing users with long-term investment options, mutual funds, and AI-powered investment advisory services. Today, Ant Fortune connects users with over 100 fund management firms, leveraging big data and AI to recommend personalized investment portfolios.

💡 Global Comparison

Similar models exist in the U.S., such as Acorns (which rounds up purchases for micro-investing) and Wealthfront, which offers robo-advisory services, and Human Interest, Guideline optimizing 401k investing. However, Yu’e Bao’s scale and integration into China’s payment system make it unique.

Credit & Loans: Huabei, Jiebei, Zhima Credit

As digital transactions grew, credit services became the next frontier. In 2014, Ant launched Huabei (Ant Credit Pay), a Buy Now, Pay Later (BNPL) service similar to Affirm or Klarna, allowing users to make purchases on credit and repay over time. Shortly after, Jiebei (Ant Cash Now) was introduced as a short-term microloan service for consumers and small businesses.

Another Ant Group’s biggest innovations was Zhima Credit (Sesame Credit), China’s first independent credit scoring system, launched in 2015. Unlike FICO scores in the U.S., which primarily assess loan repayment history, Zhima Credit evaluates a broader set of data, including spending habits, bill payments, e-commerce history, and even social behaviors. Users with high Zhima scores could enjoy privileges like deposit-free hotel bookings, bike rentals, and faster loan approvals.

However, credit and lending remain among the most heavily regulated sectors in finance. As Ant’s credit services grew, Chinese regulators stepped in, leading to major regulatory changes in 2020-2021. Ant had to restructure its lending operations and shift from being a direct lender to a financial intermediary, requiring more transparency in credit risk assessment.

💡 Global Comparison

Block (former Square) have similar ecosystem like Ant Group, Square carries the payment ecosystem like Alipay and CashApp carries the financial services ecosystem. Since 2022, its CashApp revenue already exceeded its Square revenue, taking about 58% of total Block revenue in Q3 2024, while BNPL take about 17% of it.

On the credit score side, new entries like Experian, and Equifax as well as neo-banks released its credit score booster products. Credit score plays an important role in the credit & loan products, enabling user to get access to more lending options.

Insurance Tech: ZhongAn & AI-Powered Risk Pricing

I shops (and returns) a lot online. One day Taobao recommended me a shipping insurance at checkout. I can pay ¥1 for the insurance to reduce my return shipping fee from ¥12 to ¥2 if I need to return. This product does made me feel more comfortable trying out new products. Beyond e-commerce, I also noticed Ele.me, Alibaba’s food delivery platform (think Uber Eats), offering "On-Time Insurance" at checkout for a small fee. It promised compensation if my food arrived late. Ele.me also introduced a food safety insurance product in partnership with big insurance company. If I ever encountered a food safety issue, I could request compensation directly in the app.

Such examples shown Ant Group revolutionized the insurance industry, embedding micro-insurance seamlessly into e-commerce. In 2013, Ant co-founded ZhongAn Insurance, China’s first fully digital insurance company. ZhongAn pioneered low-cost, high-frequency insurance models, such as e-commerce return shipping insurance, which let shoppers opt-in for coverage at the final checkout step. One of Ant’s most innovative insurance services was dynamic risk pricing, where AI-powered models adjust premiums based on user behavior.

Ant also expanded into health insurance (Xiang Hu Bao), a mutual aid platform that allowed users to contribute to a shared pool for medical expenses, an alternative to traditional insurance models. By 2021, Xiang Hu Bao had 100+ million users, but it faced regulatory scrutiny and was later phased out.

💡 Global Comparison

Unlike China, where micro-insurance is visibly embedded into platforms, in the U.S., similar protections exist but often without users explicitly knowing. Instead, these costs are bundled into services, platform fees, or merchant policies, making them less noticeable but equally critical:

Many platforms like Amazon and Walmart offer purchase protection through extended return policies and guarantees, but these protections are often backed by insurance providers like Allstate or SquareTrade without the consumer realizing it.

In contrast to Meituan’s explicit micro-insurance model, U.S. food delivery companies require restaurants to carry liability insurance, which means the cost is already baked into menu prices or merchant service fees.

Travel booking sites might be an exception. When users book on Expedia or Airbnb, they are asked to select between a higher price with friendly refund options and a lower price with stricter refund or no refund policies.

Many small businesses and freelancers using Stripe, PayPal, or Shopify benefit from built-in fraud protection, chargeback insurance, or shipping guarantees, but these costs are bundled into platform fees.

Lemonade, a AI-Powered insurance, offer fully digital insurance for rental, homeowners, and pet insurance, using AI-driven dynamic pricing and claims processing, similar to how Ant Group used AI in its insurance tech products. Lemondade also uses behavior-based pricing, meaning that low-risk customers pay lower premiums—similar to how Ant customizes insurance pricing based on behavior.

Next Insurance is the comparable player in the US to Ant’s SME Insurance. Next Insurance provides small business insurance with flexible coverage embedded in platforms like Shopify and QuickBooks.

Final Thoughts and Future Outlook

Ecosystem: From Payments to an Integrated Financial Platform

Ant Group’s transformation from a simple payment processor to a comprehensive financial ecosystem was driven by AI, big data, and seamless service integration. It didn’t just digitize transactions; it redefined financial infrastructure, embedding payments, credit, insurance, and wealth management into daily life. By turning Alipay into an all-in-one financial hub, Ant created an ecosystem where users could seamlessly pay, borrow, invest, and insure—all within a single platform. Once inside, users had little reason to leave.

The same principles apply to Visa, MasterCard, Block in the U.S. Payments are the entry point and more value lies in expanding financial services beyond transactions. Fintechs that evolve from single-purpose products into deeply embedded financial platforms build long-term defensibility, higher engagement, and stronger economic moats.

Risk Management: The Foundation of Fintech Success

At the heart of every successful fintech company lies risk management—balancing trust, fraud prevention, regulatory compliance, and financial sustainability. Across different markets, fintech leaders have taken unique approaches to managing risk while scaling their businesses:

PayPal pioneered AI-driven fraud detection in the early 2000s, analyzing transaction patterns in real time to cut fraud loss rates below 0.32%. By introducing Buyer & Seller Protection, it built trust, increased adoption, and secured its position as the leading global digital wallet.

Stripe’s Radar leverages machine learning to dynamically assess transaction risks, allowing businesses to reduce fraud by 98% while improving revenue by 3-5% through better risk-based authentication.

Nubank, redefined credit risk assessment by using alternative data (mobile usage, social behaviors, and bill payments) instead of traditional FICO scores. This model enabled 40M+ underbanked users to access financial services while keeping fraud rates 50% lower than legacy banks.

As the TechFin model expands, the next frontier for fintech will be balancing rapid innovation with responsible risk management. Privacy concerns, AI-driven decision-making, and regulation management will shape the next wave of digital finance. The companies that master risk while embedding financial services into daily life will define the future of fintech.