AI for Science (2): Commercializing Breakthrough Wearable Technologies

A PM's Guide to Commercialize Next Frontier Product in Personal Health & Performance

Wearable technology has evolved from simple step counters to sophisticated AI-driven health monitors. As a big fan of Apple Watch, I really enjoy using it to track my workouts, health metrics, and notifications. But there’s one thing I just can’t get used to—I want to track my sleep, but sleeping with the Apple Watch on feels cold, bulky, and distracting. This led me to explore the Oura Ring, a sleep-tracking wearable designed for comfort, developed by Oura ($5.2B post valuation, Series D).

Apple has enhanced its sleep-tracking features, but Oura Ring’s discreet form factor aligns better with user preferences. This got me thinking: A great wearable product must combine advanced technology with user-centric design. More importantly, what emerging technologies could shape the next generation of wearables?

A successful sleep-tracking product should integrate advanced technology with user-centric design. Future developments in wearable technology should aim to combine these strengths, providing both sophisticated health monitoring and a seamless user experience.

Breakthrough Technologies in Wearable Science

1. Microfluidic Sensing Technologies Replacing Invasive product with Flexible Wearables

Microfluidic sensors enable the real-time analysis of sweat, interstitial fluid, and other biofluids, providing a non-invasive approach to tracking hydration levels, electrolytes, glucose, and even stress-related biomarkers. When combined with AI, these capabilities unlock several new possibilities:

Continuous Metabolic Monitoring: AI can analyze biochemical markers in sweat or tears to predict dehydration, electrolyte imbalances, or glucose fluctuations.

Precision Health & Personalized AI Models: Unlike traditional PPG or ECG sensors, microfluidic sensors provide biochemical insights, allowing AI models to offer more personalized health recommendations.

Predictive & Preventative Health Insights: AI can integrate fluid-based biomarkers with other sensor inputs (e.g., heart rate, motion) to detect early signs of heat exhaustion, hypoglycemia, or muscle fatigue.

Adaptive AI for Athletes & Patients: Real-time biofluid sensing can enhance recovery monitoring, optimizing nutrition, hydration, and training regimens based on individual needs.

2. Wearable Blood Pressure Sensor + AI = Monitoring and Preventive Care

Advancements in wearable sensor technologies have enabled continuous, non-invasive monitoring of blood pressure (BP), offering a more convenient alternative to traditional cuff-based methods. These wearable devices employ various sensing mechanisms, such as mechanoelectric, optoelectronic, ultrasonic, and electrophysiological methods, to measure vital biosignals, including pulse rate, blood pressure, and changes in heart rhythm.

Like in the biofluid field, Machine learning (ML) also been instrumental in enhancing the accuracy of blood pressure estimation from wearable sensors. By analyzing features extracted from physiological signals like photoplethysmography (PPG) and electrocardiography (ECG), ML algorithms can estimate systolic and diastolic blood pressure values, while meeting the standards set by the Advancement of Medical Instrumentation.

Continuous Cardiovascular Monitoring: Wearable BP sensors facilitate real-time tracking of cardiovascular parameters, enabling early detection of hypertension and other cardiac anomalies.

Integration with AI for Predictive Analytics: By combining sensor data with machine learning algorithms, these devices can predict BP trends and provide personalized health recommendations.

Enhanced User Compliance: The comfort and convenience of wearable BP monitors encourage regular use, leading to better management of cardiovascular health.

3. Applied Body-Fluid Analysis Enable Multimodel Analysis using Wearable Devices

Advancements in wearable technology have enabled the non-invasive analysis of various body fluids—such as sweat, saliva, tears, and interstitial fluid—to monitor health biomarkers continuously. These innovations provide real-time insights into an individual's physiological state without the need for invasive procedures.

Potential Wearable Applications:

Continuous Glucose Monitoring: Analyzing glucose levels in interstitial fluid or sweat offers a non-invasive alternative to traditional blood sampling for diabetes management.

Hydration and Electrolyte Tracking: Monitoring sweat composition can inform users about their hydration status and electrolyte balance, crucial for athletes and individuals in physically demanding environments.

Stress and Fatigue Assessment: Detecting biomarkers like cortisol in sweat or saliva can provide insights into stress levels and overall well-being.

3. Body-Heat Powered Wearable Devices

A QUT-led research team has developed an ultra-thin, flexible film that could power next-generation wearable devices using body heat, where thermoelectric materials convert natural body heat into electrical energy. This innovation has the potential to eliminate the need for charging, making wearables more convenient and sustainable, would be helpful especially in medical devices that require continuous monitoring. This technology could also be used to cool electronic chips, helping smartphones and computers run more efficiently. In the past, researchers have been trying to bring this technology to market. Matrix Industries ($54.6M total raised, Series B) founded by to researchers from Caltech, developed a smartwatch powered entirely by body heat using thermoelectric technology, and Sequent ($3.85M total raised, Seed), a Swiss startup, introduced a self-charging smartwatch that harnesses kinetic energy from the wearer's movements, reducing reliance on traditional battery charging methods.

How to Commercialize and GTM?

1. Clear Consumer Use Case

One of the use cases for microfluidic sensors is non-invasive hydration level tracking, but for it to succeed, it must address a real, compelling user need. An obvious scenario is alerting users when to drink water, but most people already rely on natural thirst cues. This makes hydration alerts a "nice-to-have" rather than a necessity, reducing the likelihood that consumers would pay for the product.

The solution here for hydration levels analysis is to target niche, high-value markets first (e.g., endurance athletes, military, clinical use cases) before going mass-market.

Epicore Biosystems

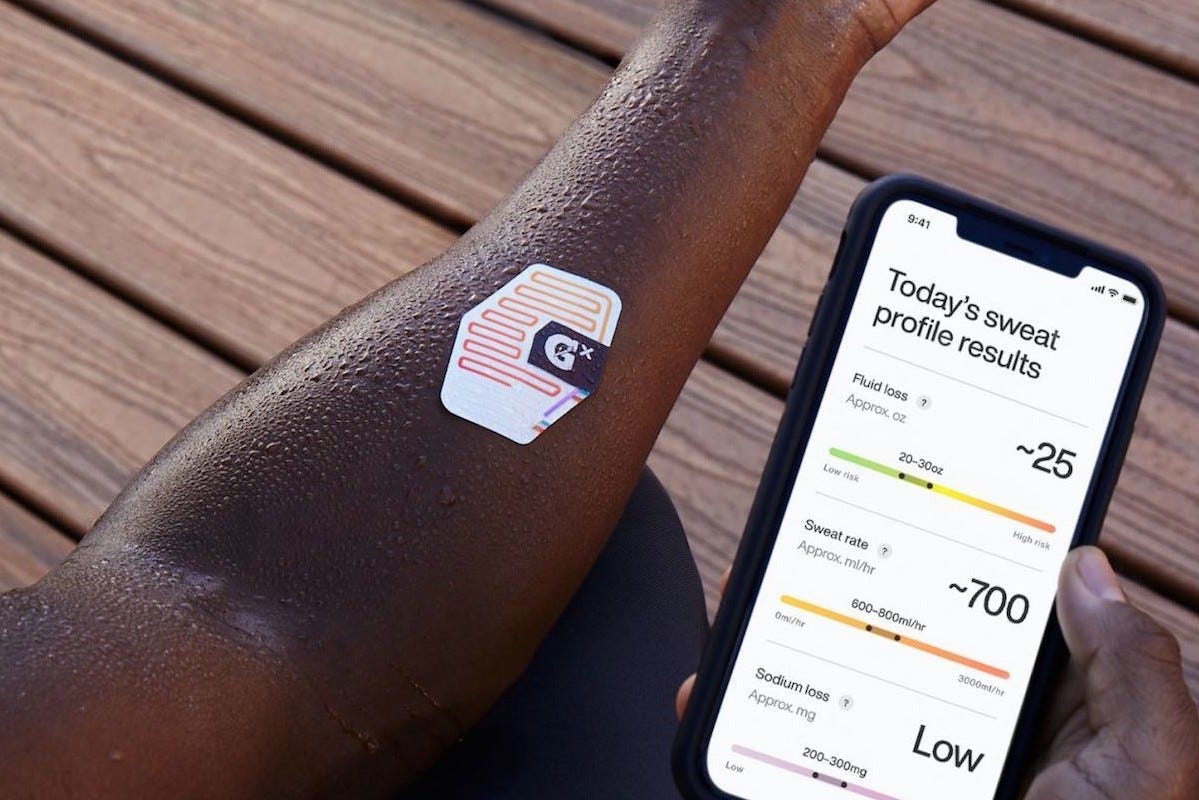

Epicore Biosystems found its product-market in athletic performance optimization. Epicore Biosystems ($115M post valuation, Series B) emerged as a startup deriving from Northwestern University's Querrey Simpson Institute for Bioelectronics, grounded in the pioneering technologies developed from the scholarly work of Professor John A. Rogers and Dr. Roozbeh Ghaffari at Northwestern University. In 2022, Epicore acquired the assets and intellectual property of Eccrine Systems, a sweat sensor research firm based in Cincinnati. Presently, the company has commercialized three products: Gx Sweat Patch, Discovery Patch System, and Connected Hydration.

In partnership with PepsiCo’s Gatorade, the company’s Gx Sweat Patch launched in March 2021. The small, sensor-packed sticker is applied to an exerciser’s forearm, providing real-time hydration recommendations via a smartphone app for optimal athletic performance and refueling for the beverage market at large. Similar collaborations could emerge with Apple, Samsung, or Fitbit for hydration and electrolyte monitoring.

Its FDA-approved Discovery Patch System goes a step further, reading biomarkers in sweat to reveal personalized insights on stress and glucose levels, in addition to hydration needs. Now, this ability to monitor and manage performance is gaining steam beyond athletics.

A similar challenge exists for wearable blood pressure monitors aimed at seniors with chronic diseases. While continuous BP monitoring is useful, most seniors already receive regular BP checks in healthcare settings (e.g., assisted living, primary care visits). Thus, BP monitoring wearables may not be compelling enough for this audience.

Xsensio

Xsensio went with clinic use cases, leveraging continuously testing technologies. Xsensio (acquired by Mayo Clinic in 2023) is pioneering the Lab-on-Skin™ platform, a wearable technology that continuously analyzes biochemical data at the skin's surface. By detecting proteins and hormones in real-time, Xsensio's platform provides unique health insights, facilitating early detection of critical health events. The company has partnered with Mayo Clinic to further develop this technology, aiming to enhance personalized patient care through continuous monitoring.

This real-time multi-model (multiple body fluid sample) monitoring technologies can be extremely helpful in early disease detection, chronic condition management, and personalized healthcare. Given its novel biochemical sensing capability, Xsensio needed to determine which market segment would benefit the most from such tech.

Instead of launching as a general consumer health wearable, Xsensio focused on use cases in medical and clinical applications, where:

✅ There is a strong need for continuous biochemical monitoring

✅ Existing solutions are inconvenient, expensive, or unavailable

✅ The market is willing to pay a premium for cutting-edge technology

After M&A, Mayo Clinic’s clinical and product development experts will provide support for Xsensio’s proprietary technology, which continuously collects and analyzes biochemical data in real-time for early detection of critical health events. The aim is to improve personalized patient care and enhance remote monitoring capabilities.

2. Clinical Validation, Regulatory Approval and Insurance Coverage (Especially for Medical Use)

Medical-grade wearables/ wearable devices intended for medical use must obtain FDA clearance, requiring extensive clinical trials. This entails a rigorous review process and extensive cycles of clinical trials. Many high-tech wearables that provide medical-grade health insights face regulatory hurdles before commercialization.

The good things is, subjecting products intended for the medical field to the most stringent FDA scrutiny represents a practical and effective safeguard for consumers at the source. On the other hand, concurrently, this regulatory rigor considerably prolongs the pre-market waiting period for sweat sensing devices in the early stages of commercialization, escalates research and development costs and risks, and decelerates the pace of their commercial advancement.

Wellness-focused wearables (e.g., Oura Ring, Fitbit), instead of classifying as medical device, targeting general customers, allowing faster go-to-market timelines.

Biolinq

Biolinq (total raised $249M, late stage) is a healthcare technology company based in San Diego, California, specializing in the development of wearable biosensors aimed at enhancing metabolic health. Founded in 2012, Biolinq has focused on creating a minimally invasive, skin-applied electrochemical biosensor platform capable of monitoring multiple analytes, including glucose, ketones, and lactate. This technology provides actionable health insights without the discomfort associated with traditional monitoring methods. Biolinq's primary focus is on individuals managing diabetes, offering a less invasive alternative to traditional blood glucose monitoring systems. Thus facing competition from existing products:

We see some clear benefits, including minimizing discomfort comparing to invasive or deep sensor insertion, eliminating the need for calibration frequent sensor replacement (unlike traditional CGMs), and potentially expanding to track beyond glucose to ketones, lactate, and other metabolic indicators.

However the FDA approval and clinical validation is something they need to work on. Biolinq initiated a U.S. pivotal clinical trial in March 2024 to evaluate the efficacy and safety of its glucose sensor, with plans to submit the device for FDA clearance upon successful completion.

They are competing against well-established brands (Dexcom, Abbott, Medtronic) in a highly regulated space, so they needs a strong differentiation strategy to convert existing CGM users while also expanding into new markets (e.g., general metabolic health monitoring). Once its approved, Biolinq would also need to work on insurance coverage as many CGMs like Dexcom and FreeStyle Libre have established insurance coverage pathways.

SiPhox Health

SiPhox Health ($52M post valuation, Series A) located in Boston with extensive leadership in silicon photonics, optical chip technology, microfluidics, and biochemistry. Their mission is to develop novel home lab testing solutions that are comprehensive, convenient, and affordable to enable proactive and personalized healthcare. Currently, SiPhox has a marketed mail-in home blood test kit that measures 17 biomarkers for inflammation, cardiovascular risk, metabolic health, and hormonal balance.

SiPhox is now working towards FDA clearance for its flagship product SiPhox Home. The device will offer a broad menu of proteins and hormone tests from a finger prick blood sample and produce results in under five minutes.. It’s also significantly lighter (1 pound vs. 500 pounds) and cheaper ($300 vs. $500,000) than industry lab equipment. In the meantime, the company has launched a mail-in blood collection kit that measures 17 biomarkers for inflammation, metabolic, hormonal, and cardiovascular health.

In December 2024, SiPhox Health partnered with knowRX to integrate in-home lab testing into knowRX's The Owl App platform. This collaboration aims to empower patients by providing convenient at-home testing, thereby improving compliance and health outcomes.

3. Drive User Adoption

For most wearable products leveraging advanced technologies, there are already existing products with less sophisticated but established solutions. This means customers won’t switch unless the new product delivers significant value over their current option. The perceived Net Value of adopting a new product is determined by:

Net Value = (New Product Value - Old Product Value) - Switching Cost

Consumer adoption hinges on three main factors: usability - customers can achieve their needs; easiness to use - Customer can achieve their needs while save cost and improve efficiency; and stability - increase the possibility of achieving the first two.

Accuracy and medical-grade certificates: A wearable must provide highly accurate and meaningful insights that users cannot get from existing products. If an advanced biometric tracking wearable offers only incremental improvements over a cheaper alternative, consumers are unlikely to switch.

Battery Life & Simplicity: Long-lasting battery life plays a critical role in usability. Users already accustomed to charging a smartwatch daily might hesitate to adopt a new wearable that introduces yet another device to charge. Innovations like body-heat-powered wearables solve this problem, removing a key adoption barrier.

Integration and Ecosystem Compatibility: Wearables that work within existing ecosystems (Apple Health, Google Fit, Garmin, Fitbit, etc.) significantly reduce the switching cost for users. Standalone devices that require users to adopt new apps and disconnected ecosystems face higher resistance to adoption.

Pricing-Market Fit: If alternatives exist at lower price points, users won’t justify the extra cost. To use latest tech in product can be costly, company first to market could either reduce cost or target premium users (e.g., elite athletes, research institutions, hospitals).

WHOOP

Whoop ($483M total raised, pre-IPO) is a wearable technology company renowned for its fitness tracker that emphasizes continuous health monitoring, particularly focusing on metrics such as sleep, recovery, and strain. Founded in 2012 by Will Ahmed, Whoop has carved a niche among athletes and fitness enthusiasts seeking in-depth physiological insights. This company differentiates itself from mainstream competitors like Apple, Samsung, and Fitbit by focusing on a highly specialized user segment, premium experience, and unique data-driven insights. Instead of competing directly on hardware features, WHOOP has built a sticky ecosystem based on performance optimization and continuous engagement.

Market Positioning – Specialization Over Mass Appeal

Apple, Samsung, and Fitbit cater to mass-market consumers, offering wearables that blend fitness tracking, smart notifications, and general wellness features. Whoop, on the other hand, targets serious athletes, fitness enthusiasts, and professionals who want deeper recovery and performance insights. Instead of competing on breadth of features, WHOOP focuses on depth of data. It emphasizes performance optimization, strain, recovery, and sleep readiness, areas where Apple Watch and Fitbit provide only basic insights. Apple and Fitbit offer “general wellness”; WHOOP sells elite performance tracking.

Pricing & Business Model – Subscription vs. One-Time Purchase

Mainstream competitors (Apple, Samsung, Fitbit) follow a traditional hardware business model – users pay upfront for the device and get basic features for free, with optional paid subscriptions (e.g., Fitbit Premium, Apple Fitness+).

Whoop gives the hardware for “free” but charges a premium monthly subscription ($30/month, $480 for 24 months). This fits companies have less brand awareness in a crowded market by lowering the upfront switching cost. This also helps Whoop sidesteps direct price wars with Apple and Fitbit, focusing on monetization through insights rather than hardware sales.

Wearability & Design – No Screen, More Focus

Whoop has no screen – users interact only through the mobile app, ensuring a focus on data rather than distractions. This also enable Whoop to have 24/7 wearability with extended battery life (5+ days) and lightweight comport. On the behavior shift side, it encourages continuous use without interruption aligns with its brand as a performance-focused wearable.

Data & Personalization – AI-Driven Health Insights

Whoop differentiates by giving actionable insights rather than raw data. Apple Watch are more focus on trend analysis, goal achieving (activity rings), while Whoop users get customized strain recommendations and predictive readiness scores. Athletes trust Whoop to optimize workouts, recovery, and strain, making them reliant on the platform.

Community & Professional Adoption – Social Proof & Validation

Whoop has built credibility by partnering with professional athletes, military, and fitness influencers. For example, Whoop is used by NFL, PGA Tour, and military special forces, adding credibility that mass-market wearables lack.